The importance of insuring van equipment

Incorrect cover in existing policies:

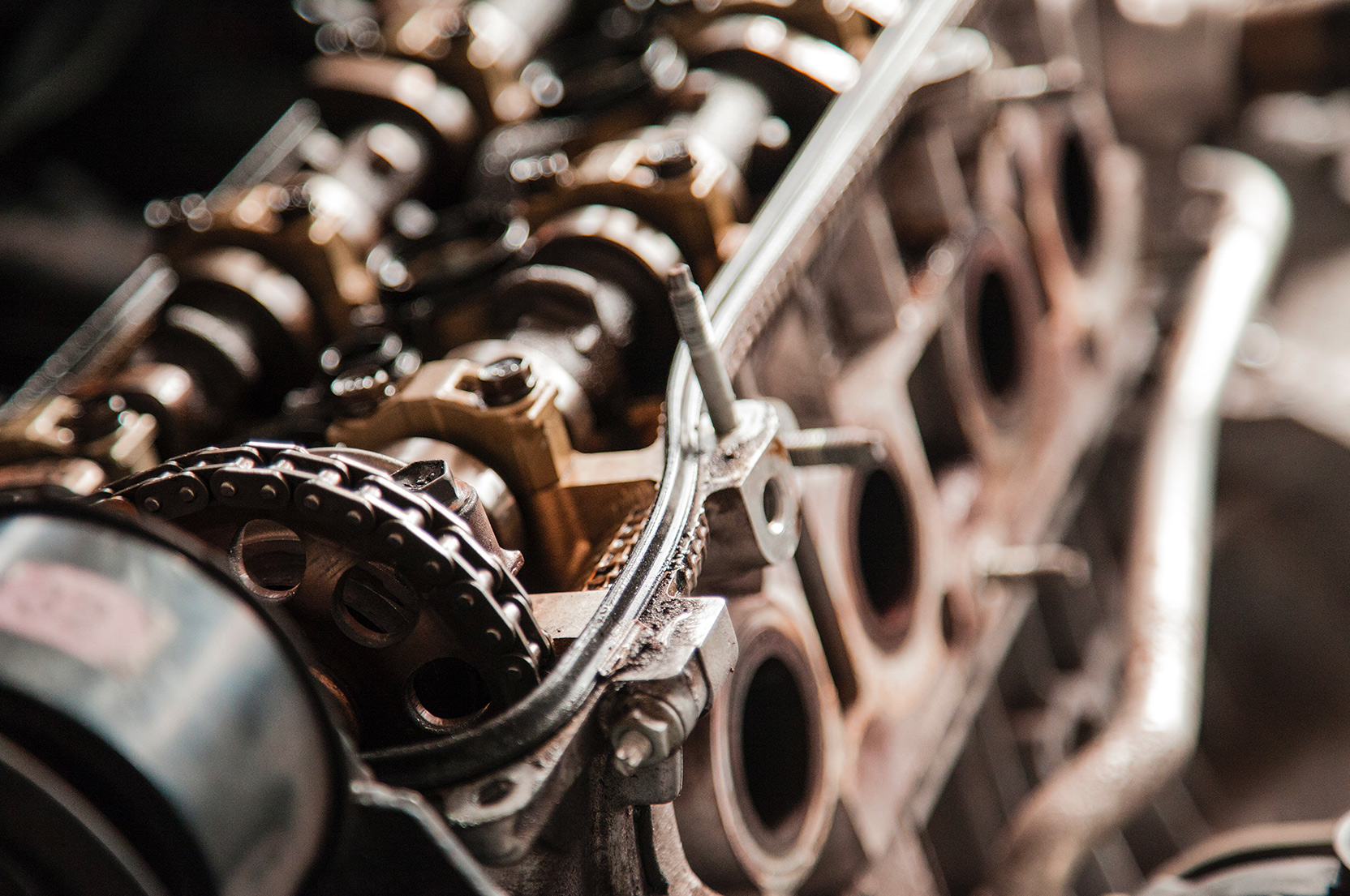

Not insuring the contents of your Mobile Units & Recovery Trucks is a dangerous strategy, particularly with levels of theft on the increase from vehicles left unattended or parked overnight. If you have a motor trade policy, you may think the equipment inside your Mobile Units & Recovery Trucks is automatically covered, especially if it’s fixed. Darren Gowers, who manages NLIG’s Motor Trade department, can tell you otherwise and has seen too many examples of clients’ existing policies not providing adequate cover.

“We have many years’ experience in the Motor Trade Insurance arena,” he says, “which means we know exactly what to look for when a potential new client asks us to review their motor policy. A classic situation involves a client with a motor trade policy that covers their Mobile Units & Recovery vehicles, unaware it may not include the equipment inside the vehicle. In the event of theft, this is potentially very detrimental to the health of the business.”

Darren can cite a number of examples where he has encountered just this scenario, fortunately being able to rectify the situation and ensure appropriate cover is reinstated. He explains some of the situations he has encountered over the years:

“One of our clients operates a mobile tyre fitting business with three mobile units, fully kitted out with tools and equipment. When the client first came to us he was with another broker and asked us to review his insurance. We took one look at his policy and immediately identified that none of the tools or equipment, worth around £30k, was insured. Once he’d appointed us, it was a simple matter of sorting this out with the insurer.”

“We identified a similar problem with another client who runs a large Service & Repair Centre. They offer a mobile repair service to a major client, who are a national double glazing company, to reduce the amount of time their vehicles are off the road. When we reviewed their existing policy, we found no cover in place for the contents of their 2 Mobile Units, one with around £40k’s worth of equipment, the other with equipment to the value of £60k. Eighteen months after we arranged cover to include the equipment, the van fitted with £60k’s worth of equipment was stolen. With watertight cover in place, the claim was accepted by the insurer and full settlement was issued. Without NLIG’s initial intervention, however, it would have been a very different story.”

Losing a van with equipment to the value of £60k, without insurance, would certainly strike a major blow moneywise. But it’s not just about the money. Unable to carry out day to day work, a client would run the risk of losing customers and contracts, and also suffering reputational damage, from which the business might not recover.

“Our client was very happy they had changed to NLIG,” says Darren. “The premium might have increased slightly to cover equipment and tools, but it absolutely paid off some eighteen months later. It just goes to show how important it is to check cover is in place and that it provides adequate protection against risk exposure.”

If you would like us to review your motor trade policy and ensure it provides the level of protection your business requires, please call us on 01992 703007 or email insurance@nlig.co.uk